By T. D. Thornton

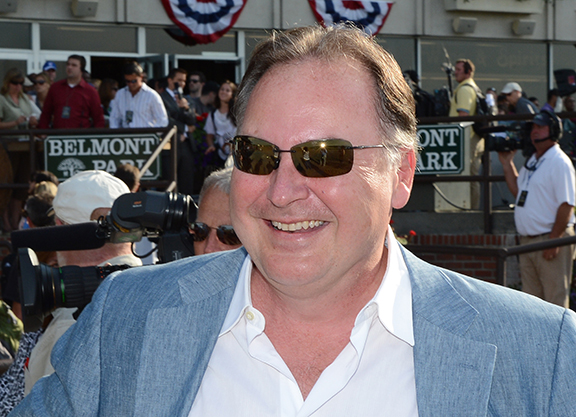

Claiming zero income and total liabilities of $1.763 million, Richard “Rick” E. Dutrow, Jr., the GI Kentucky Derby-winning trainer whose long history of racing infractions resulted in a 10-year suspension that is currently in effect until 2023, filed for Chapter 7 bankruptcy in federal court Apr. 4.

According to his 54-page filing with the United States Bankruptcy Court for the Eastern United States, the 57-year-old former trainer of 2008 Derby winner Big Brown (Boundary) is unemployed, does not own or lease a vehicle, and has access to only $50 in cash and $12.50 in a joint checking account with his former wife, Victoria.

Dutrow owes a $1,304,817 mortgage on a home he bought in 2006 in East Norwich, N.Y., but he is claiming that the value of the property is only $1,015,000. He indicated in the filing that he is claiming the home as “exempt” and would like to retain it. Chapter 7 bankruptcy, also called “straight” or “liquidation” bankruptcy, cancels many debts, but does allow for a court trustee to liquidate some property to repay creditors.

Beyond the home, which is considered “secured property,” Dutrow listed unsecured debts totaling $458,199.

Two racing-related entities are among those creditors owed money, according to the filing: Stanley Penn & Sons Feed, Inc., located near Belmont Park, has already won a court judgment against Dutrow for $228,296. The New York State Racing & Wagering Board (NYSRWB) is listed twice in the filings in the creditor section, once for $30,113 and another time for an “unknown” dollar amount. In 2011, in addition to his 10-year suspension, the NYSRWB fined Dutrow $50,000 after one of his Aqueduct winners tested positive for an opioid analgesic and syringes containing a painkiller and a sedative were found in Dutrow's stable office.

Dutrow has spent the better part of a decade appealing his litany of medication-related penalties in several jurisdictions, and in 2013 he filed a federal lawsuit seeking monetary damages and a reinstatement of his licensure. The Albany office of the prominent national law firm Hinckley Allen Snyder, LLP is listed as an $85,803 creditor.

A Kentucky debt collection agency also won a court judgment for payment against Dutrow for $71,412.

The Internal Revenue Service is listed as a “priority unsecured” claimant; a dollar amount listed as “unknown” pertains to unpaid taxes between 2002 and 2005.

Consumer purchases, medical bills, tax- and debt-reduction services, and a nearly $5,000 debt to a company that installs custom ponds and waterfalls make up the rest of Dutrow's list of creditors.

According to Equibase, Dutrow's horses earned more than $87 million between 1979 and 2013. His horses won multiple graded stakes (including two Breeders' Cup races) and he often topped the trainer standings at New York tracks during the 2000s decade.

But Dutrow's rap sheet of racing offenses totals at least 75 infractions spread out over multiple jurisdictions. In addition to his well-documented troubles with equine medication violations, his sanctions further include multiple penalties for personal drug use, check forgery, falsified applications, failing to report a criminal conviction, plus various license refusals for “moral turpitude,” “evidence of unfitness,” and attempts to “deceive state racing officials.”

Not a subscriber? Click here to sign up for the daily PDF or alerts.